The business of contemporary art has changed immeasurably over the last half century. What was essentially a small, insider trade clustered in a few key avant-garde capitals has expanded into a professionalized multinational, multi-billion dollar industry.

American collectors fly to Beijing to source canvases from the latest up-and-coming Chinese painters; Korean curators commission work for upcoming exhibitions from artists in Sydney and Sao Paulo; auction houses open regional offices to service a newly wealthy global elite at a rate surpassed only by the raw number of galleries, biennials, fairs and publications that now clutter the landscape.

Art has gone global and the imprint of big business is felt throughout.

Other creative industries, of course, have followed a similar path—but perhaps none as spectacularly or perplexingly as the world of high art. The shock value of a $10 million price tag for a work straight from an artist’s studio has few equals.

In Art of the Deal I cut below the surface of these shifting tides. I look at how these changes have come about, why and where business is heading.

Unlike other accounts of the trade that focus ad nauseum on the successes of a few acclaimed household names—Andy Warhol, Jeff Koons and Damien Hirst, most commonly—this book offers an account of some of the subtler but all the more profound recent developments.

I consider in depth the rise of art investing and the commercial forces of a wide range of artistic practices such as video, performance, installation and experiential art, long thought to exist outside of the market but now central to its operation.

In the end, the book provides a critical lens into the art world’s fascinating but opaque processes that I hope will stir the minds of scholars, professionals and a curious public.

The book will have achieved its goal if your next encounter with art—whether in a museum, gallery, studio, library, online, wherever—gives you just a little more pause about the uses and values of these objects.

A few basic tropes characterize writing on the art market.

Economists focus almost exclusively on the auction trade, and paintings in particular. The reason is straightforward enough: auction sales are public record (unlike dealer transactions which take place behind closed doors), and paintings make up the bulk of its value. Years of economic research have produced a solid understanding of the cyclical ebbs and flows of prices at auction, and recent writing has shed intense light on the historical returns of investing in art—an imperfect science, but one of extreme interest in the market and a focal point of Art of the Deal.

At the opposite extreme, art historians, critics, curators and artists obsess over the role of value in a much broader sense. Painting, for this camp, constitutes but one of many equally vital multidisciplinary practices. Art’s philosophical, metaphysical and museological import reign supreme over commercial reality. The market, in turn, is often perceived as a little more than a necessary means to an end, while talk of investment is taboo. Dealers, themselves, are complicit in the game, with leading galleries seldom affixing prices to the wall and instead framing their sales process as a complex social dance—all the easier to make something as truly “priceless” if it has no obvious price.

My academic background bridges economics and art history and the book speaks multiple languages at once. It reigns in key economic concepts and data all too often absent in art market writing and blends these with an understanding of the major recent developments in today’s artistic practice and discourse—from the rise of conceptual art to the opportunities and challenges of art’s migration online.

Readers from all sides should come away with a new appreciation of how the contemporary art market functions and the many nuances of today’s trade.

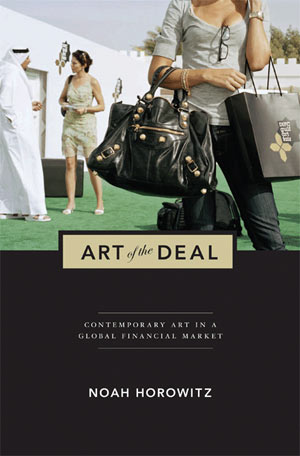

The book’s cover image tells a powerful story. Martin Parr, the photographer, is one of my favorite artists. Over the years, he’s built an incredible body of work documenting the minutia of contemporary consumerism—from the quirky luxuries of an aspiring English middle class, to fashion trends and tourist destinations overseas. His characteristic use of bright colors, unexpected juxtapositions, up-close-and-personal details (think high heels, lipstick-smeared champagne glasses, cigarette butts and plastic surgery) and a deadpan blend of seriousness and irony is unmistakeable.

A few years ago he did a series of photographs at art and other high-end trade fairs. I loved these piercing images and encouraged my publisher to see if we might be able to use one for the cover. Parr obliged and the photo we selected, taken at the 2007 DIFC Gulf Art Fair in Dubai, is an amazing snapshot of art and business being conducted in today’s global marketplace: the bejewelled woman in the foreground with her flashy purse and art fair tote bag talking on her cell phone, and the man in traditional Arabic garb in the rear perhaps brokering a deal with a Western-looking woman.

Art of the Deal takes a serious look at these issues and Parr’s photograph offers a fun entry-point to them, delivering meaning and substance from the go. The holding power of Parr’s image revealed itself to me shortly after the book was published when, in March earlier this year, I traveled to Dubai to attend this art fair for the first time and found this earnest yet bizarre scene of East meeting West repeating itself ad infinitum.

I hope, of course, that people actually delve within the book. And, for a general reader, the preface and introduction provide a wealth of accessible insight into how the art market works. From Damien Hirst’s famous sale at Sotheby’s in 2008, as the financial markets crumbled, to the rise of China and the Middle East as newly important centers of the trade, there’s plenty to be grasped.

Bridging the language gap between the artistic and economic is absolutely huge.

The art market has expanded wondrously in recent years and there’s more writing on, and interest in, the business of art than ever before. And yet the discourse on it hasn’t quite kept pace.

The quality of economic research on the art market is improving but its full valence is still constrained by some of the qualifications mentioned above. Gossipy insider accounts prevail. And many on the critical Left continue to hold the market in contempt.

While I can certainly appreciate these tendencies, we also need to move beyond them—to adequately address why investing in art may sound sexy and lucrative in the abstract but is incredibly difficult to pull off in practice, how today’s multidisciplinary artists fund their careers, and what are the many opportunities and challenges these pose to collectors of contemporary art.

Black and white polarities, arguably captured most famously in sociologist Pierre Bourdieu’s writings on High and Low culture in avant-garde Paris, are increasingly a thing of the past. Art of the Deal will have achieved its goal if it pushes the envelope on this front and enables audiences on all sides to have a better appreciation of their own positions and a clearer perspective on the overall art market debate.

To this end, I also hope that my book acts as a toolbox for future scholars, critics, and thinkers. Art of the Deal brings a wide range of ideas to the table, from finance theory to intellectual property law and relational aesthetics—and there is a lot left to do, to position these concepts in within today’s trade.

And lastly, a lot has changed since the book’s concluding analysis of the bursting of the art market bubble in 2008-09: 2010 was a record period for the auction houses and a boom mentality is brewing again. These rapidly shifting tides are ripe for further commentary and I hope that some of the ideas that come together at the end of my book (about the role of art market cycles and developing trends in museums, galleries and online) provide a solid sounding board for new reflections to come.

Noah Horowitz is an art historian and expert on the international art market. He has edited and contributed to publications on contemporary art and economics for institutions including the Serpentine Gallery, London, the Astrup Fearnley Museum of Modern Art, Oslo, and the United Kingdom’s Intellectual Property Office. He received his Ph.D. from the Courtauld Institute of Art, London, and currently lives in New York, where he is a member of the faculty of the Sotheby’s Institute of Art and director of the VIP Art Fair.